Performance-Focused MarketMaking technology for Web3: Revolutionizing Digital Asset Trading

Stay in control of your token. SellSides offers the opportunity to build up your own liquidity and manage it actively with our technology. You remain in control of the liquidity you provide and thus don't give away a share of your tokens

Craft a market development strategy for your token leveraging the expertise of SellSides.

Upon receiving your specifications, our team of experts will carefully devise a bespoke, comprehensive strategy to promptly address your unique needs. Additionally, we offer continuous risk management services for your markets, ensuring robust practices and constant support 24/7, all year round.

Drawing on the skills of our talented team, we are dedicated to supporting Web3 initiatives and boosting profits. Our offerings include extensive assistance across 100+ Centralized Exchanges (CEXs) and over 10 Decentralized Exchanges (DEXs) spanning 5 unique blockchains, guaranteeing a robust and efficient trading experience.

Liquidity 24/7

Our algorithms are always running. Algoritms that never sleep.Even during public holidays.

Transparent

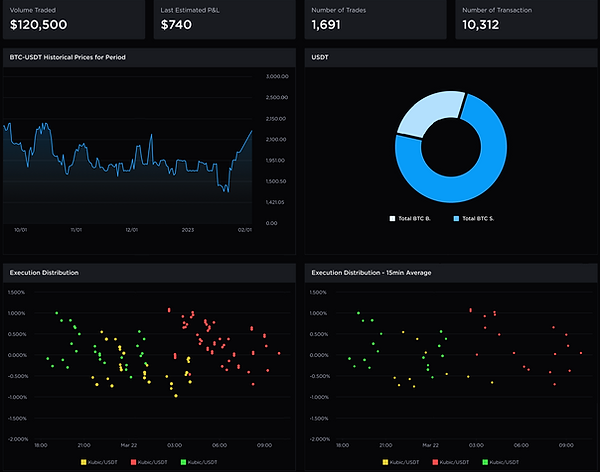

Receive daily and monthly reports of your trading activities. Access live dashboards to monitor your asset valuations

Compliant

We never trade against you, and we always work in your best interests. We enforce this with stringent conflict-of-interest policies

Cost efficient

Sell where everyone buys and buywhere everyone sells. Your capital, your strategy, your P&L.

We are connected to the leading exchanges, brokers, and liquidity providers

Integrated with more than 100 different exchanges, CEXs, DEXs, brokers, banks, and LPs.

This gives clients freedom to choose any liquidity partners and venues they wish, without technology constraints. SellSides’ purpose built infrastructure facilitates low latency connectivity and supports: FIX protocol market/trade, WebSocket API, REST API, Public API and Private API.

Access the analytics needed to trade in any market condition, across any alpha or risk horizon